Navigating cross-border complexities

Transacting across the borders of South Africa comes with complexities and risks.

Our consultants and partners can guide you through these often intimidating scenarios.

Valuable exchange control advice

South Africa remains one of the few countries that continues to operate an exchange control system. The purpose is to monitor and manage the transfer of funds into and out of the country.

The strict and often complex regulations apply to everyone and all transactions, irrespective of the amount.

It’s extremely important to remain within the boundaries of the law as getting it wrong can very quickly land you in hot water with the South African Reserve Bank and result in significant financial penalties.

By talking to the experienced team at FX Rand you’ll have peace of mind knowing that no matter how complex your situation we’ll have a solution that ensures you achieve your objectives and at the same time remain fully compliant.

Our initial consultation is free of charge, so why not connect with us for expert guidance.

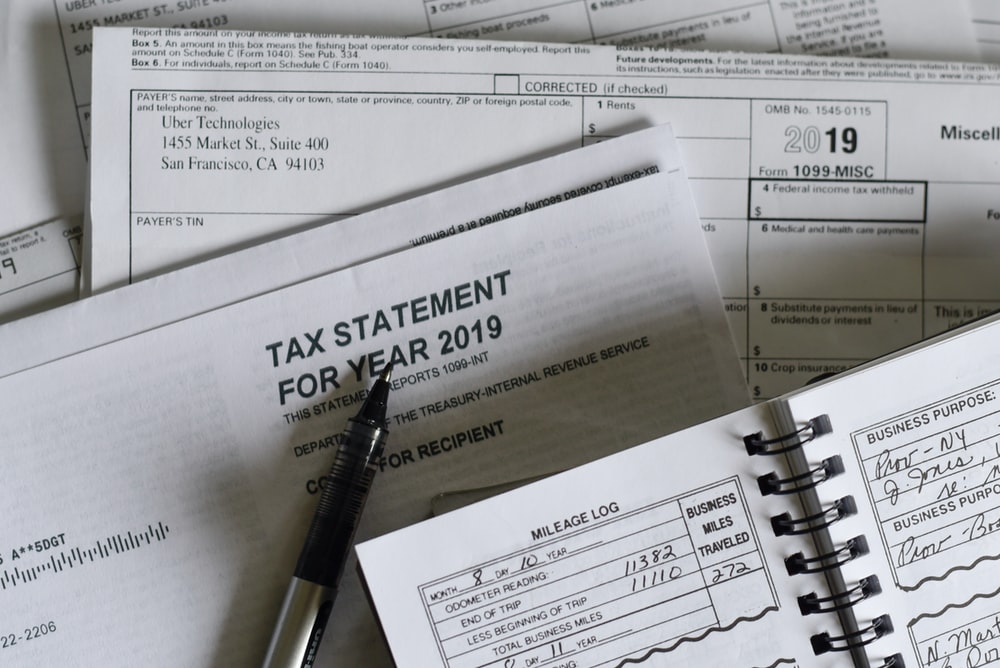

Essential cross-border tax advice & help

Tick the tax box!

When it comes to crossing borders, whether it’s you, your wealth, or both, tax is always a key consideration. When one factors in the complexities of associated exchange control legislation it becomes even more important to get it right.

In fact, for many people, it is often the actual tax legislation that dictates decision making when it comes to cross border transacting and investment.

At FX Rand we connect you with experienced advisors to support you in knowing you’re doing things in a tax efficient manner and at the same time remaining fully compliant in whichever countries you have a “financial footprint”.

Whether it’s immigration, emigration, cross border transacting, offshore investment or international structuring, let us connect you with specialists who have all the answers.